Due Date for Filing 1099-INT Form for 2023 Tax Year

Provide Recipient Copy

Paper Filing Deadline

E-filing Deadline

The IRS Form 1099-INT deadline for the 2023 tax year . Below are the due dates for filing Form 1099-INT

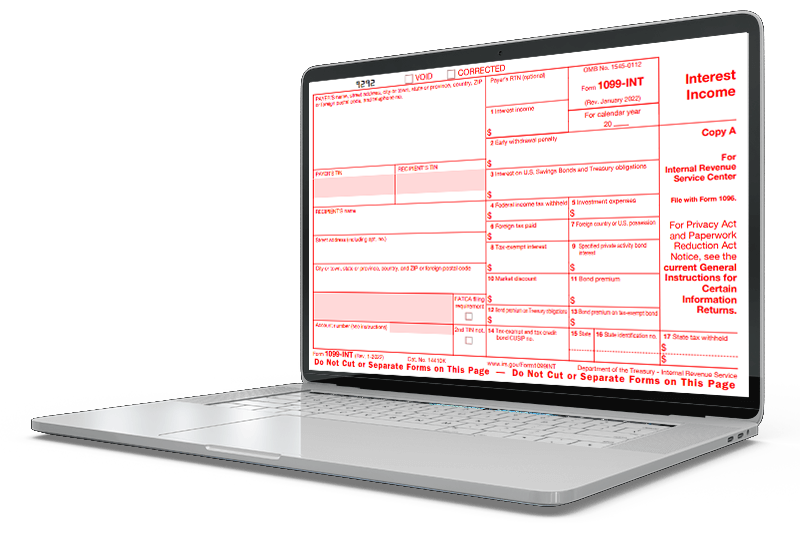

Form 1099-INT - Interest Income

Form 1099-INT, Interest Income is an annual 1099 tax statement furnished by payers of interest income greater than $10 including expenses associated with the payment. 1099 Forms are required to be filed with the IRS (Internal Revenue Service) on a yearly basis.

To learn more about 1099-INT Form - visit: https://www.taxbandits.com/1099-forms/what-is-form-1099-int

Who Must File Form 1099-INT?

Any organization such as Banks, Mutual Funds & Financial Institutions which has paid interest income, withheld foreign tax on interest or withheld federal tax under the backup withholding rules must file form 1099-INT with the IRS.

New Changes to 1099 Forms for 2023 Tax Year

For the 2023 tax year, Form 1099-NEC has been reintroduced. Form 1099-NEC is used to report payments of $600 or more made to nonemployees or independent contractors. The following payments should be reported in Form 1099-NEC:

- Fees

- Commissions

- Prizes

- Awards

- Other compensations

Earlier, these payments were reported on Box 7 of 1099-MISC. Due to the confusion in the deadlines, the payers are required to file Form 1099-NEC for 2023 tax year separately.

Learn more about Form 1099-NEC.

Why E-Filing is Best?

By e-filing 1099-INT, you can save a lot of time by conveniently completing your form. The entire process is incredibly easy and provides more accuracy and reduces filing errors. You will also reduce the amount of paperwork you have to deal with and all of your records will be stored online in one location with easy access. But best of all, you will receive instant acknowledgment from the IRS via email once your form has been received.

What Information is Required to E-File 1099-INT?

The following information is required to be reported when filing IRS Form 1099-INT online:

- Payer Details : Name, EIN, Address, Payer Type, and Employee Code

- Recipient Details : Name, SSN, Address, and Contact Information

- Federal Details : Federal Income and Federal Tax Withheld

- State Details : State Income, State Tax Withheld, and Payer State ID Number

Learn more about Form 1099-INT Information.

Efile1099INT.com - A Cloud Based Solution to File Form 1099-INT Online

Our cloud-based solution to file 1099-INT online includes a multitude of exclusive, innovative e-filing features.

Efile1099INT.com is the best way to e-file your 1099-INT. You can simply go to efile1099int.com to get started. We have error checks in place to make sure that you do not leave any necessary boxes blank. Do you need to file a return for last year? Then you've come to the right place. We support Form 1099-INT for the current tax year as well as the previous tax year. There are no additional charges for contacting our locally based support team. If you have any questions do not hesitate to contact our Customer Support Team at 704.684.4751, by live chat, or by e-mailing support@TaxBandits.com for more information.

State Filing

State Filing

Depending on your state, you need to e-file 1099-INT form with the respective state department and include additional information. efile1099int.com supports 1099 state filings for those who participate in the Combined Federal and State Filing Program (CF/SF).

Bulk Upload

Bulk Upload

When you e-file 1099-INT, don't waste time by adding recipient information one by one. Instead, use our bulk upload feature to upload all your recipient information at once & save time!

Print Center

Print Center

Our print center feature allows you to view or download the copies of your transmitted 1099-INT forms at any time.

Postal Mailing

Postal Mailing

We will not only e-file your Forms with the IRS, also will print and mail the copies of 1099-INT forms to your recipients with our Postal Mailing feature.

Steps to E-File 1099-INT Form

Login

The first step for filing 1099-INT is to go to efile1099int.com an IRS authorized e-file provider for complete tax filing solution. To login, just click on the Sign-In button. From here, just enter some basic information to set up your efile1099int.com account. Please note: It is totally free to create an account. You only pay per return. For quick access click below link.

Select Form 1099-INT

After signing up, you will be taken to the Dashboard of your account. To file a new 1099-INT Form, just click on "Form 1099-INT" and add your basic information

- Payer Name

- Choose "Type of TIN"

- Employer Identification Number (EIN) / Social Security Number (SSN)

- Address

- Phone Number

- Email Id

Add Recipient Details

You need to add the recipent for the form 1099-INT or you can add by bulk upload. And You need to add all the contact information such as:

- Recipient Name

- Choose "Type of TIN"

- Employer Identification Number (EIN) / Social Security Number (SSN)

- Address

- Phone Number

- Email Id

Add Federal / State Details

Here you can add the federal information of 1099-INT Form. You can add the amount details and collect information about amounts that need to be reported to the federal government.

You can also add the information for 1099-INT Form state filing. You can collect information that need to be reported to the corresponding states.

Pay & Transmit to IRS

After completing these processes you can pay & transmit Form 1099-INT to IRS.

For more information visit www.taxbandits.com or contact our support center in rock hill, sc at 704.684.4751 or email us at support@taxbandits.com.

1099-INT Extension Form 8809

The extension for 1099-INT form is done through extension form 8809, which offers 30 days automatic extension. This form can be filed either through paper or online. Within a few minutes, you can e-file 1099-INT extension using our system.

Learn more about Form 8809.

Form 1099-INT Penalties

If you don't file 1099-INT by the deadline you will have serious penalties to face. Penalties are enforced for the failure to file by the deadline, the failure to include all of the required information, including the wrong information, and for paper filing when you're required to e-file. The size of the penalty varies based on the size of your organization and on how late your return is. The penalty amounts range from $50 to $1,113,000.

Learn more about 1099 penalties.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to E-File Form 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.